With an unstable financial situation in the country or the world, the purchase of real estate is always the most profitable and reliable investment. The main thing is to choose the right country for the investment to work for you. In this article we will analyze why buying real estate in Georgia is a strategically correct decision, and why a spare apartment or house abroad is your irreplaceable insurance in case of problems.

The main advantages of purchasing housing in Georgia include low prices and obtaining a residence permit for investment. As well as a stable and promising real estate market in Tbilisi and Batumi, which will allow you not only to resell real estate at a better price if necessary but also to receive regular income from renting out housing.

Residence permit for investment

One of the most popular ways to obtain a residence permit in Georgia is by investing in real estate. Buying real estate in Georgia for the purpose of renting out quickly pays off and brings large incomes. Against the background of rising rental prices, the acquired property can be resold profitably. All this and the absence of tax on the purchase of real estate attracts foreign investors. Read more about the registration and taxation of real estate transactions in Georgia here.

Buying real estate in Georgia from a developer or inexpensive housing that is in high demand will not be difficult. But buying real estate just because it seemed to you profitable from a financial point of view is not worth it. You need to look for properties that have a competitive advantage over other real estates. And in order to understand this, you need to pay attention to such factors as the area, the price per square meter in dollars, the state of repair, and the estimate of maintenance costs.

Advice: Compare the cost per square meter in USD only.

By purchasing real estate in Georgia with a cost of at least $ 100,000, you not only invest your money securely, but also get a residence permit in Georgia, and at the same time you can enjoy all the rights similar to residents of the country. Namely: to engage in entrepreneurial activity, work, study, obtain visas without leaving the country, and even send invitations to other foreign citizens.

How to choose a property

Before buying real estate, you need to determine the main goals for yourself and study the market. To rent out real estate to tourists, it is better to choose Old Tbilisi and apartments in new buildings on the coast of Batumi. But the economic center of Georgia with many office buildings is suitable for leasing commercial real estate.

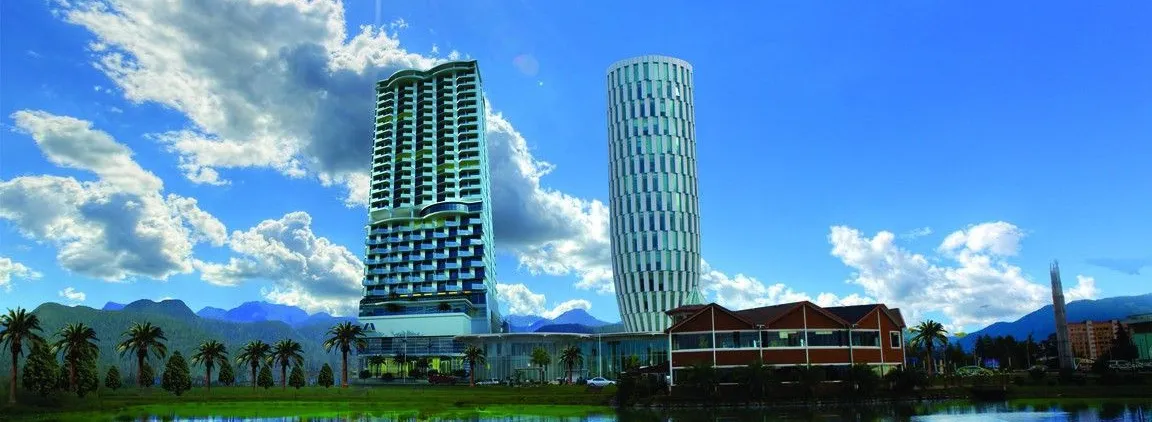

Batumi

The city on the Black Sea coast has been undergoing rapid development for many years. You can see from the photo how significantly the appearance has changed during this time.

Due to the fact that there is a wide selection of real estate in Batumi, prices start from $ 400 to $ 2500 per sq.m. Real estate from a developer in Batumi can be purchased even with a black frame, which will significantly reduce the price, but then you will have to do everything yourself, from screed and plaster to cosmetic repairs.The tourist season in Batumi is only 4 months, among which the hottest in August. Therefore, it is important to understand that there are a lot of studio apartments designed for tourists, and prices are predictably going down. In the rest of the year, people mainly come to Batumi for the purpose of visiting casinos and choose apartments and premium hotels. The benefits of investing in real estate in Batumi can be understood from the figures for 2018: the price increase was 7.2%, and the profitability from the rental of real estate is estimated at 9.5%.New buildings in the New Boulevard area are most in-demand among buyers, most of the premium-class apartments are located here and the cost can reach $ 2,000 per sq.m. More budget-class housing is located in the suburbs (Chaobi, Benz, and Ureki) and in the periphery (Kakhaberi, Chakvi, Makhinjauri, Khelvachauri, and Gonio / Kvariati).

Tbilisi

In Tbilisi, unlike Batumi, the tourist season never ends, and life is in full swing day and night because the majority of the population of Georgia lives here. Apartments are bought for renting out in Old Tbilisi, Saburtalo, and Vera. For commercial purposes, it is better to buy real estate in the Vake and Saburtalo districts.It is important to know that the condition of housing in the old part of the city leaves much to be desired, major repairs are often required, and for a similar price, it is sometimes better to consider apartments in new buildings closer to the outskirts. Such housing is also in great demand due to the fact that in Tbilisi a large number of universities and foreign students are ready to rent small apartments not in the center, but within walking distance to the metro.The average cost per square meter in new buildings in Tbilisi is $ 600 -1900 per sq.m. On the secondary market in Tbilisi, the average cost of 1 sq.m. housing was $ 656 / sq.m.

Real estate taxes

When buying real estate in another country, in addition to basic expenses and general market analysis, you should carefully study tax policy. Georgia is one of the most tax-loyal jurisdictions, so you don't have to pay tax when buying real estate, but there are other cases you should be aware of.

Rental housing

The income tax that is provided for renting real estate in Georgia primarily depends on the type of property. When you rent out the property for the actual residence of the tenants, the income tax will be equal to 5% of the rent you receive or 20% on the difference between the costs associated with the rent and the actual income. In the case of renting real estate for commercial use, the income tax will also be 20% of the difference.As for small businesses, the individual entrepreneur, when renting out real estate, will pay 20% of the income received and the preferential rate of 1% does not work. Income tax when renting real estate is always charged at the source of payment (if it is a company or individual entrepreneur). The tax rate is equal for residents and non-residents. For example, if a citizen of any other country owns real estate in Tbilisi and makes a profit from rent, then he is obliged to register with the tax authorities and submit a tax return every year and pay taxes on time by April 1 of the year following the reporting year.

Property tax

Several factors affect how much your annual property tax rate will be:

- up to 100,000 lari - from 0.05% to 0.2%;

- from 100,000 lari - from 0.8% to 1%.

The rate will be different depending on which municipality your property is located in.For example, with income up to GEL 100,000:

- in Tbilisi and Batumi - 0.2%;

- in Kazbegi and in New Gudauri - 0.08%;

- in Mestia - 0.1%.

If your family's income does not exceed 40,000 lari per year, you do not need to pay property tax.

Individual property tax must be declared annually by November 1 of the next reporting year and paid by November 15 of the same year, that is, the tax for 2020 will be paid in 2021.

Land tax

If you have a land plot in Georgia, you must pay land tax. This applies to both foreigners and citizens of the country. It is very simple to calculate the rate, the main thing is to take into account several factors.

- Plot size:

the coefficient should not be more than 1.5.

- Location of the plot of land:

the municipalities of Georgia set different rates within the limits established by the Tax Code of the country. Not less than 0.24 GEL per one square meter.

For example, the tax on a non-agricultural land plot of 200 sq.m in Tskneti (Vake district, Tbilisi) is calculated as follows: base rate 0.24 / 1 sq.m * coefficient 1.0 * area 200 sq.m, = 48 lari.

When you don't need to pay land tax:

- in case of natural disasters, when the site was damaged by 50 percent or more;

- for the site on which the apartment building is located;

- for a plot on which a private residential building and / or a garage are located (in Tbilisi, this applies to the total area of land that is listed in the documents for the dwelling and / or for the garage, but is not used for economic activities).

If you have decided on a reliable investment in real estate in Georgia, then you can make a deal without even arriving in the country. Leave a request and get a free consultation on all your questions.